XDR for Defense SOC Market. This comprehensive report presents detailed insights into market size, growth drivers, restraints, opportunities and regional dynamics, offering defence security decision-makers a robust intelligence tool.

XDR for Defense SOC market size was valued at $4.2 billion in 2024 and is projected to reach $13.7 billion by 2033, expanding at a CAGR of 13.8% during 2024–2033.

As global defence postures modernise and multiple threat vectors converge, defence SOCs are evolving from isolated endpoint protection to unified platforms that span endpoint, network, cloud, identity and operational domains. This shift underpins the market trajectory and the strategic importance of XDR for defence environments.

Request a Sample Report: https://researchintelo.com/request-sample/55424

Market Drivers

Several factors are propelling the XDR for Defense SOC market globally:

Growing number of APTs and targeted cyber-espionage campaigns against defence and intelligence agencies. National-level defence modernisation programmes that prioritise cybersecurity investments and procurement of advanced SOC capabilities.

Integration of artificial intelligence (AI) and automation into SOC workflows, enabling faster incident detection, investigation and mitigation across heterogeneous data sources.

The shift from point solution security tools toward unified XDR platforms that provide end-to-end visibility and manage the expanding attack surface (including IoT/OT, cloud and hybrid environments).

Restraints

While growth is strong, the market has notable restraints:

The high cost of procurement, integration and ongoing maintenance of XDR-powered defence SOCs can limit adoption, especially in emerging economies.

Shortage of skilled cybersecurity personnel and SOC analysts capable of leveraging advanced XDR tools remains a challenge.

Fragmented regulatory and compliance frameworks across geographies, especially in defence sectors, can cause delays and increase complexity for deployment.

Legacy system inertia and reluctance of some defence organisations to shift from established platforms pose adoption barriers.

Opportunities

The report identifies key opportunity pockets for vendors, system integrators and defence IT stakeholders:

Cloud- and hybrid-deployment models for XDR are gaining traction, enabling agile defence SOCs and cost-efficient scaling.

- Defence contractors, research institutions and homeland-security units are increasingly adopting XDR for SOCs, thus expanding the end-user base beyond traditional military organisations.

Increasing convergence of cyber-physical systems (CPS), IoT and OT in defence environments opens fresh use-cases for XDR solutions tailored to operational environments and mission-critical infrastructure.

Market Dynamics & Value Figures

The study offers full-scale market dynamics contextualised by value and volume:

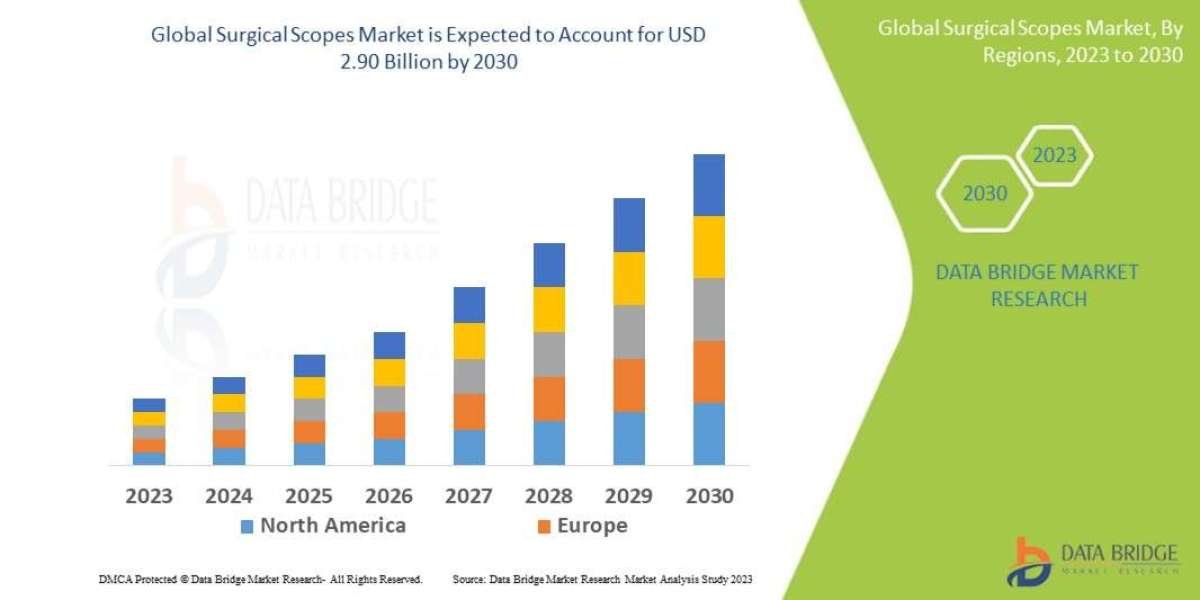

Regional share: North America presently commands over 38 % of the market in 2024, driven by mature cybersecurity infrastructure, strong defence budgets, advanced SOC ecosystems and regulatory frameworks such as CMMC and FISMA.

Deployment mode trends: On-premises remains dominant due to data-control and compliance requirements, but cloud and hybrid deployment modes are gaining momentum especially in Asia Pacific and emerging regions.

Application segmentation: Primary application segments include Threat Detection, Incident Response, Security Monitoring and Compliance Management—each contributing significantly to demand.

End-user segmentation: Military organisations account for more than 45 % of the total demand in 2024, followed by intelligence agencies, homeland security and defence-contract ecosystem.

Global Insights

The global outlook highlights both the established and emerging regional market landscapes:

North America leads due to early adoption, high defence IT spend and strong regulation.

Asia Pacific is the fastest-growing region, backed by national defence upgrades in India, Japan, South Korea and China.

Latin America, the Middle East & Africa (MEA) remain nascent but are gaining traction; growth is constrained by budgetary limits, skills gaps and fragmented regulatory regimes.

In emerging defence markets, partnerships, local SOC development and vendor tie-ups are accelerating XDR for defense SOC adoption.

Strategic Takeaways

For defence policymakers, cybersecurity planners and SOC leaders, the following insights stand out:

Investing early in XDR-enabled SOC infrastructure can deliver measurable gains in threat detection speed, incident response times and overall mission-readiness.

Harmonising deployment strategy—balancing on-premises control with cloud-enabled scalability—can simplify operations and optimise resource utilisation.

Prioritising training and SOC-analyst capacity building is critical to unlocking the full value of XDR platforms in defence environments.

Monitoring regional posture and partner ecosystem readiness is vital: vendors, integrators and service-providers with defence-specific SOC experience provide differentiation.

View Full Report: https://researchintelo.com/report/xdr-for-defense-soc-market

Professionals interested in leveraging the full scope of this research have multiple options:

Request a sample to evaluate detailed findings, tables and figures.

https://researchintelo.com/request-sample/55424Enquire for customisation tailored to specific regions, segments or deployment scenarios.

https://researchintelo.com/request-for-customization/55424Check out the full report to access 250+ pages of content, 48+ expert reviews and forward-looking analysis.

https://researchintelo.com/checkout/55424