Global Friction Stir Welding Market Overview (2024–2030)

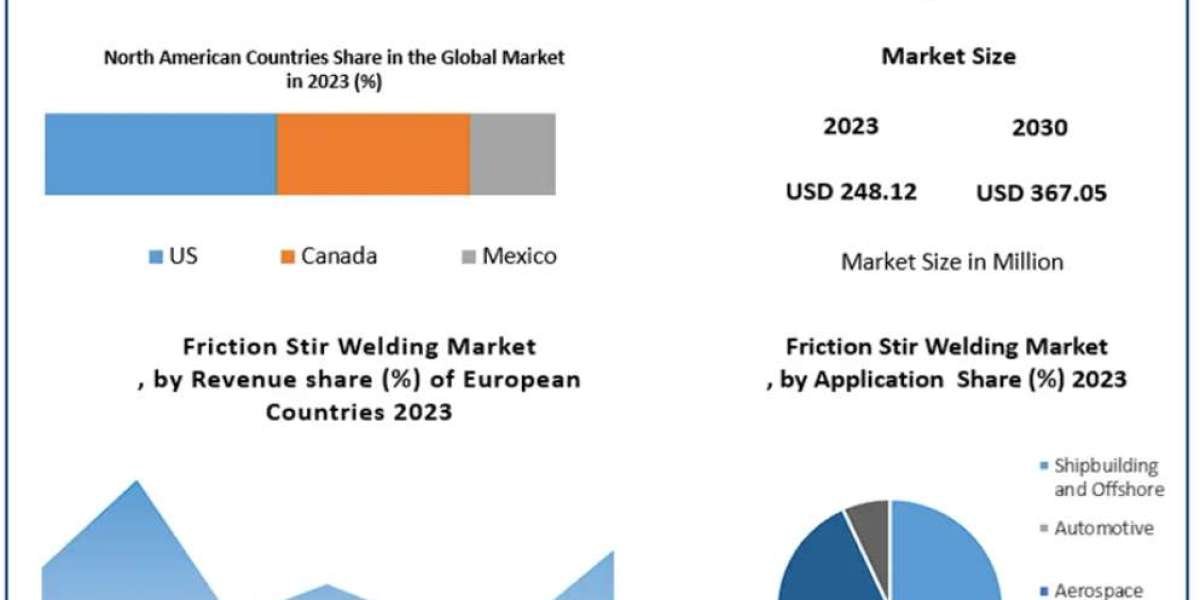

The Friction Stir Welding (FSW) Market was valued at USD 248.12 million in 2023 and is projected to grow at a CAGR of 5.75% from 2024 to 2030, reaching approximately USD 367.05 million by 2030.

Friction stir welding is a solid-state joining process that creates high-strength welds without melting the materials. The process uses a non-consumable rotating tool that generates frictional heat, softening and bonding the material along the joint line. Unlike conventional welding, FSW eliminates the need for filler materials, flux, or shielding gases, offering advantages such as cost efficiency, energy savings, and enhanced mechanical performance.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10856/

Market Dynamics

The global FSW market is expanding rapidly, driven by its rising adoption in the automotive, aerospace, shipbuilding, and railway sectors. Increasing demand for lightweight materials in vehicle manufacturing and sustainable industrial welding solutions is propelling the market’s growth trajectory.

Key Growth Drivers

Rising automotive production: Manufacturers increasingly rely on FSW to join aluminum components, reducing vehicle weight and improving fuel efficiency.

Technological advancements: Innovations in machine automation, adaptive control, and real-time monitoring enhance process precision and throughput.

Expanding defense and aerospace sectors: The demand for defect-free, high-strength joints is accelerating FSW adoption in aircraft and defense equipment manufacturing.

Sustainability focus: The eco-friendly nature of FSW—requiring less energy and producing minimal emissions—aligns with global green manufacturing initiatives.

Challenges

Despite its benefits, market expansion faces hurdles such as a shortage of skilled operators, technical complexities, and high initial equipment costs. Addressing these barriers through workforce training and R&D investment will be crucial for sustained growth.

Market Segmentation

By Equipment Type

Fixed Friction Stir Welding (FSW)

Adjustable Friction Stir Welding (AFSW)

Self-reacting Friction Stir Welding (SFSW)

The Fixed FSW segment held the largest share (52.3%) in 2023. Its popularity stems from superior stability, accuracy, and suitability for high-volume industrial applications. Fixed machines offer consistent weld quality and are favored by automotive and aerospace manufacturers seeking repeatable, high-precision results.

By Material

Aluminum Alloys

Magnesium

Titanium

Copper

Steel Alloys

Others

Aluminum alloys dominate the market due to their lightweight properties and high weldability, making them ideal for electric vehicles, aircraft, and rail systems.

By Application

Shipbuilding & Offshore

Automotive

Aerospace

Railway

Others

The railway segment led the market in 2023 and is anticipated to grow at a CAGR of 6.02% during the forecast period. The technology’s cost-effectiveness, durability, and ability to produce uniform welds are driving its adoption for rail track manufacturing and maintenance. The automotive sector is also poised for strong growth, propelled by electrification trends and the shift toward autonomous vehicles.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10856/

Regional Insights

Asia Pacific (APAC)

The Asia Pacific region is projected to dominate the global FSW market throughout 2024–2030. Strong growth in automotive, railway, aerospace, and defense industries is creating substantial opportunities for FSW equipment suppliers.

China continues to lead global vehicle production, with an estimated 35 million units projected annually by 2025, driving large-scale adoption of friction stir technology.

India’s defense manufacturing output exceeded USD 12.6 million in 2023, marking over 12% growth year-over-year, reflecting the country’s investment in FSW-enabled production.

Europe

Europe maintains a significant market share, supported by technological innovation and the presence of leading machine manufacturers in Germany, the UK, and France. The region’s focus on advanced aerospace and high-performance transportation systems further reinforces market expansion.

North America

North America is experiencing steady growth due to the rising use of aluminum in electric vehicles and industrial automation in welding operations. The U.S. remains a key hub for research and development in FSW technology.

Competitive Landscape

The global FSW market is moderately consolidated, with leading players investing in R&D, automation, and strategic collaborations to strengthen their global footprint.

Recent Developments

Hitachi High-Technologies Corp. (Japan) launched a new generation of FSW machines in August 2023 for the automotive and aerospace industries, featuring enhanced precision and reduced cycle times through advanced monitoring systems.

ESAB Group Inc. introduced the Rebel™ FSW in September 2023, offering adaptive control and automatic parameter optimization, expanding the accessibility of FSW for varied material applications.

Key Market Players

Concurrent Technologies Corp. (USA)

FOOKE GmbH (Germany)

Gatwick Technologies Ltd. (UK)

HFW Solutions LLC (USA)

Hitachi High-Technologies Corp. (Japan)

Manufacturing Technology, Inc. (MTI) (USA)

Midea Group (KUKA AG) (China/Germany)

Norsk Hydro ASA (Norway)

PaR Systems LLC (USA)

Yamazaki Mazak Corp. (Japan)

Beijing FSW Technology Co., Ltd. (China)

The ESAB Group, Inc. (USA)

KUKA Systems GmbH (Germany)

MegaStir (USA)

Eta Technology Private Limited (India)

Grenzebach Maschinenbau GmbH (Germany)

Colfax Corporation (USA)

Schlumberger Limited (USA)

Market Scope

| Report Coverage | Details |

|---|---|

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Historical Data | 2018–2023 |

| Market Size (2023) | USD 248.12 Million |

| Market Size (2030) | USD 367.05 Million |

| CAGR (2024–2030) | 5.75% |

| Segments Covered | Equipment Type, Material, Application, and Region |

Conclusion

The Friction Stir Welding Market is entering a transformative phase, supported by innovations in automation, robotics, and material sciences. With strong demand across automotive, aerospace, and defense industries, FSW is emerging as a cornerstone technology for next-generation manufacturing. The Asia Pacific region will remain a dominant growth hub, while Europe and North America continue to drive technological evolution and high-performance applications.