The global SWIFT Transaction Manager Market is gaining remarkable momentum as financial institutions adopt advanced solutions to manage cross-border payments and streamline transaction processing. SWIFT Transaction Managers play a crucial role in enhancing payment efficiency, transparency, and compliance across global banking networks.

SWIFT Transaction Manager solutions enable financial institutions to process transactions securely and efficiently, reducing errors and delays. These platforms facilitate seamless communication between banks, enhancing reconciliation, settlement, and reporting processes.

Research Intelo’s latest analysis highlights that the increasing volume of international transactions, coupled with growing regulatory complexities, is propelling demand for sophisticated transaction management solutions worldwide.

https://researchintelo.com/request-sample/77627

Key drivers accelerating the SWIFT Transaction Manager Market include the rapid growth of global trade and cross-border payments. Financial institutions require reliable platforms to ensure swift, compliant, and transparent transaction execution.

Regulatory compliance is another critical factor. Increasing scrutiny from global regulators mandates strict adherence to anti-money laundering (AML) and know-your-customer (KYC) requirements, which these solutions help enforce.

Additionally, the rising adoption of digital banking and fintech innovations has increased the need for automated, real-time transaction management systems capable of supporting high volumes and complex workflows.

Despite strong growth drivers, the market faces notable restraints. Integration complexities with legacy banking infrastructure can slow adoption, requiring significant technical investment and expertise.

The high cost of deployment and maintenance is another barrier, especially for smaller banks and financial institutions with limited budgets.

Concerns regarding data security and privacy, particularly when managing sensitive financial data across borders, also temper rapid adoption.

https://researchintelo.com/report/swift-transaction-manager-market

The SWIFT Transaction Manager Market presents substantial opportunities through continuous technological advancements. Artificial intelligence and machine learning integration promise enhanced fraud detection, predictive analytics, and operational efficiency.

Cloud-based transaction management platforms offer scalability, cost efficiency, and rapid deployment, attracting increasing interest from institutions looking to modernize.

Market participants are also exploring partnerships and interoperability enhancements to provide comprehensive, end-to-end solutions covering the full transaction lifecycle.

Research Intelo forecasts the market will grow at a robust compound annual growth rate during the forecast period, driven by sustained increases in global financial activity and regulatory compliance demands.

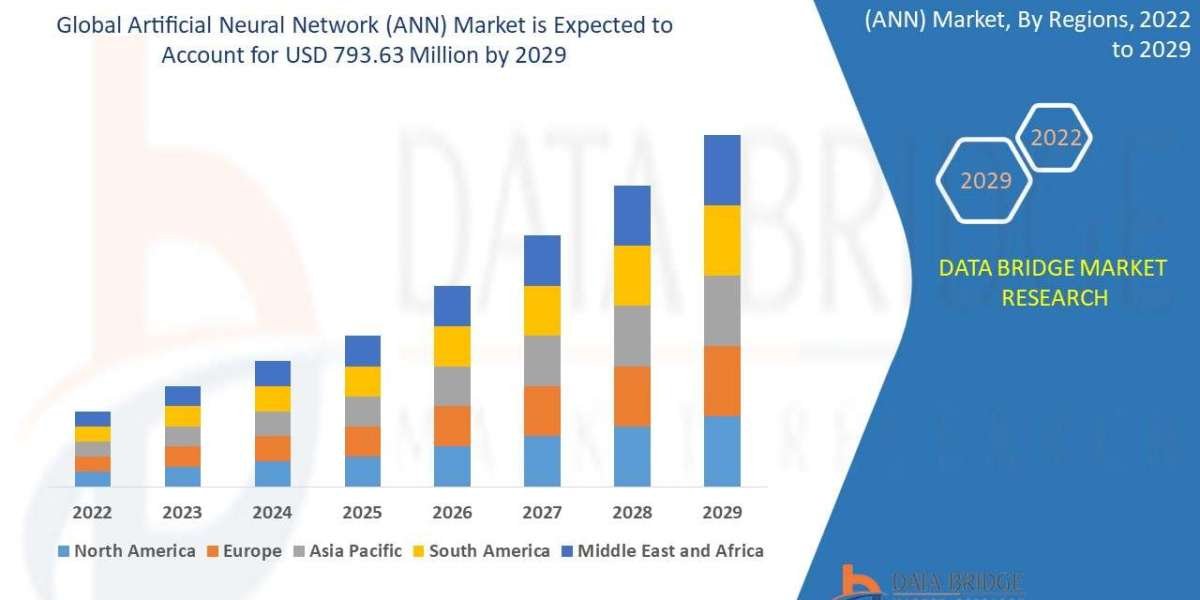

Regionally, Europe dominates the market due to early adoption of SWIFT infrastructure and stringent regulatory frameworks. North America follows closely, benefiting from advanced financial technology ecosystems and high transaction volumes.

Asia Pacific is poised for rapid growth, fueled by expanding international trade, increasing digital banking penetration, and government initiatives promoting financial inclusion.

Key market segments include:

By Deployment: On-premise and cloud-based solutions

By End User: Banks, financial institutions, and corporate treasuries

By Functionality: Transaction processing, compliance management, reconciliation, and reporting

This segmentation highlights the diverse needs and solution types within the SWIFT Transaction Manager Market.

Notably, trends in this market mirror those in the Study Abroad Agency Market (Primary SWIFT Transaction Manager Market), where efficient transaction processing and compliance are pivotal to operational success.

https://researchintelo.com/request-for-customization/77627

Looking ahead, the SWIFT Transaction Manager Market is set to evolve with increasing emphasis on automation, real-time processing, and enhanced security protocols. Emerging technologies such as blockchain may further influence transaction transparency and traceability.

Research Intelo underscores that institutions adopting integrated, flexible transaction management platforms will be well-positioned to navigate evolving regulatory landscapes and competitive pressures.

In conclusion, the SWIFT Transaction Manager Market offers significant growth potential, driven by globalization, regulatory complexity, and digital transformation. Research Intelo’s comprehensive report provides detailed insights into market size, trends, and regional dynamics, empowering stakeholders to make informed decisions in the dynamic world of cross-border financial transactions.

About us:

Research Intelo is a full-service market research and

business-consulting company. Research Intelo provides global enterprises as

well as medium and small businesses with unmatched quality of “Market Research

Reports” and “Industry Intelligence Solutions”. Research Intelo has a

targeted view to provide business insights and consulting to assist its clients

to make strategic business decisions and achieve sustainable growth in their

respective market domain.

Contact us:

Name: Alex Mathews

Phone no: +1 909 414 1393

Address: 500 East E Street, Ontario, CA 91764, United

States

Email: sales@researchintelo.com

Website: https://researchintelo.com/

LinkedIn: https://www.linkedin.com/company/research-intelo/